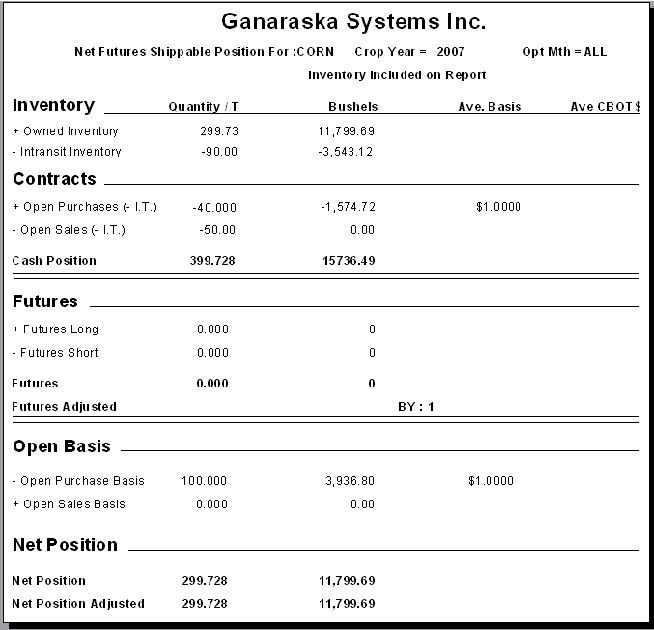

Position

The Futures position screen can be accessed from the Main Menu under Inventory | Futures Position. The above screen will display.

- Select the Commodity required from the drop down list. In this case we have selected CORN.

- The current price is displayed if entered in the Grain Defaults table.

- The user can select to include Inventory (owned) or not. The check box is checked in this example.

- The User can select to include In-Transit Inventory (shipping Orders) or not. The Box is checked in this example..

- For Crop Year and Option Month you can select ALL or, as in the above screen we selected 2007 and ALL.

The remainder of the screen shows that the Cash Position is 15736 Bushels, we are Long yet the Net Position is 11799 Bushels which is our real position.

The following is a list of fields on the screen and their meaning:

Contracts

- + Owned Inventory – The amount of grain that is owned by the Elevator including any grain in off-site locations.

- – Intransit Inventory – the amount of Shipping orders not accounted for by contracts

- + Open Purchases – The total open contracts yet to be received.

- – Open Sales – The total amount of contracts yet to be shipped.

- Cash Position – This is calculated from the above as follows

Owned Grain + Open Producer Purchases – Open Sales = Cash Position

Futures

- +Futures Long – This is the futures, if any, hedged long in Chicago for CORN.

- – Futures Short – The amount of Short futures hedged in Chicago

- Futures Adjusted – This field is a calculated see below

- -Open Purchase Basis – The total purchased Basis or DP Contracts.

- +Open Sales Basis – The total sold on Basis or DP Contracts

- Net Position – The final calculation that determines whether you are long or short.

(Futures Long X Exchange Rate) – (Futures Short X Exchange Rate) = Futures Adjusted

The Exchange Rate must be entered on the screen if you wish to adjust the futures. This enables the user to calculate the currency exchange if hedging in Chicago and trading in a different currency.

Position Report